More on performing a due diligence

Due diligence is a comprehensive appraisal of a business or individual to establish their assets and liabilities and evaluate their commercial potential. It’s often performed before entering into a business transaction, such as a merger, acquisition, or investment.

Key Steps in Performing Due Diligence

-

Define Objectives: Clearly outline what you aim to achieve with the due diligence process. This could include understanding financial health, legal compliance, or operational efficiency.

-

Financial Review: Examine financial statements, including balance sheets, income statements, and cash flow statements. Look for consistency, accuracy, and any red flags.

-

Market Analysis: Evaluate the company’s market position, competition, and growth potential.

-

Management Evaluation: Review the qualifications and track records of the company’s management team1.

-

Risk Assessment: Identify potential risks and how they might impact the business or investment.

Types of Due Diligence

- Financial Due Diligence: Focuses on verifying the financial health of the company.

- Legal Due Diligence: Ensures all legal aspects are in order.

- Operational Due Diligence: Looks at the efficiency and effectiveness of the company’s operations.

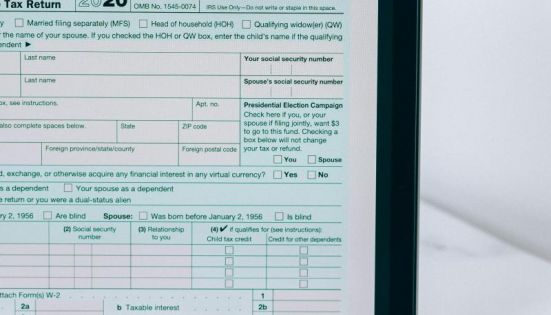

- Tax Due Diligence: Reviews the company’s tax obligations and compliance.

Performing due diligence is crucial for making informed decisions and mitigating risks in business transactions. If you have any specific questions or need further details, feel free to ask!